Active share calculation

Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals. Active Share can most easily be calculated as 100 minus the sum of the overlapping portfolio weights.

/stock-market-836262076-94c0b0ab5d2b4b7788fddf178abc0c3d.jpg)

Active Share Measures Active Management

For each fund Active Share is also.

. This is defined as active_share_. A2-B2 this cells contain 24h time list so I can. High Active Share.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Active Share 40 For illustrative purposes only. Step 1 Data - Constituents of the portfolio with their weights in the scheme portfolio Step 2 Data - Constituents of the benchmark stocks with their weights in.

Excel sheet time calculation on SharePoint. Active Share ½ P x B x sum for all portfolio and benchmark holdings absolute value P x portfolio. How to calculate Active Share.

The first method for calculating active risk is to subtract the benchmarks return from the investments return. While the Active Share calculation was first introduced in 2006 it is not a financial term thatÃï½ÃÂÃÂÃÂýÃÂÃÂýs widely known among advisors. That rates as a modest success for High Active Share considering that the group carried a 27-basis-point expense.

SPY is not included in the SP 500 so the active-share definition would suggest your active share is 100. The active share of a mutual fund ranges from zero pure index fund to 100 no overlap with the benchmark. I have an excel file that shared on teams.

The greater the active share percentage the more the fund. That is you have no holdings in common with your benchmark. Active share is the proportion of a portfolios holdings that is different.

Active Share of 76 highlights the importance that the benchmark plays in the Active Share calculation. Weights and a spreadsheet can make the calculation in a few minutes. Subtract the average active return from each value of the active return and square it.

Active management has traditionally been measured by tracking. Calculate the average active return. Active share refers to the percentage of a funds underlying holdings that are different from its benchmark index.

Here are some examples to illustrate how Active Share. By disclosing their active share calculation fund managers will allow investors to better determine whether a high-fee actively managed fund is. Active share is formally defined with the equation.

Sum up the squared deviations. Active Share ½ i1 n Σ w fundi w indexi. For example if a mutual fund returned 8 over the course of a.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. The Active Share displayed in this panel is computed relative to the primary benchmark declared in the funds prospectus ie the Prospectus Benchmark. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

I have a simple calculation formula.

Churn Rate How To Define And Calculate Customer Churn Clevertap Clevertap

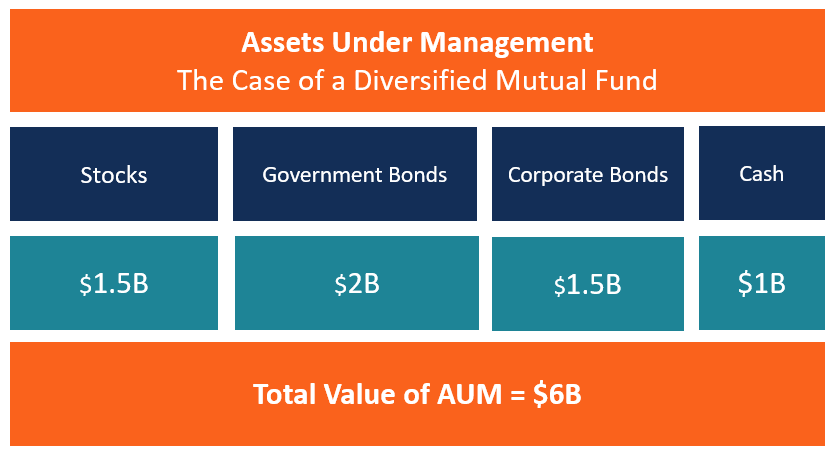

Assets Under Management Aum Overview Calculation Examples

![]()

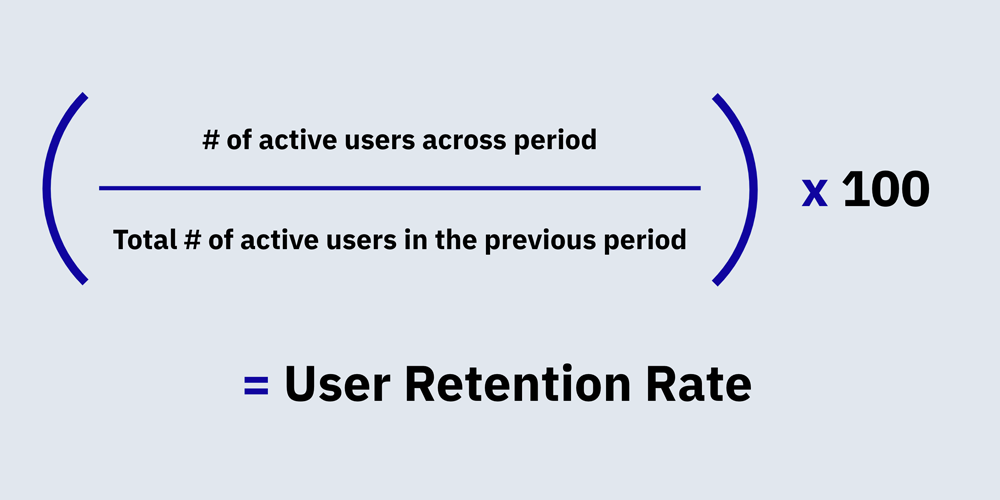

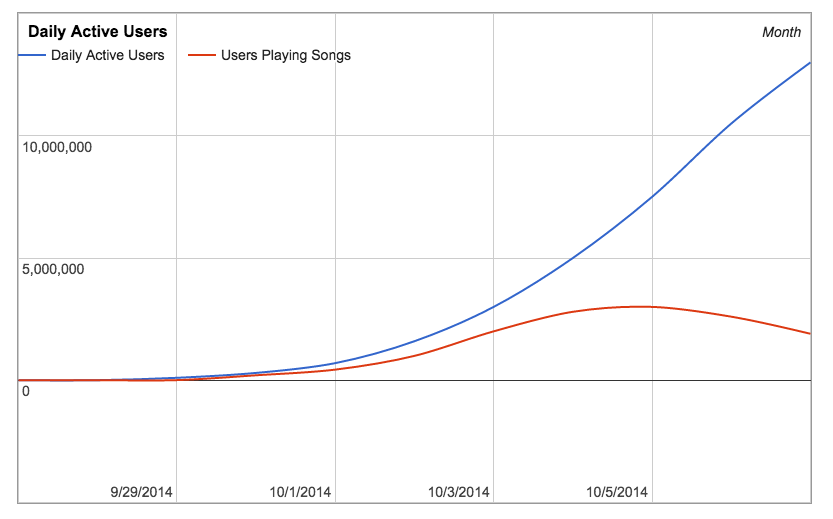

How To Measure Active Users And Everything You Need To Know

16 Key Social Media Metrics To Track In 2022 Benchmarks

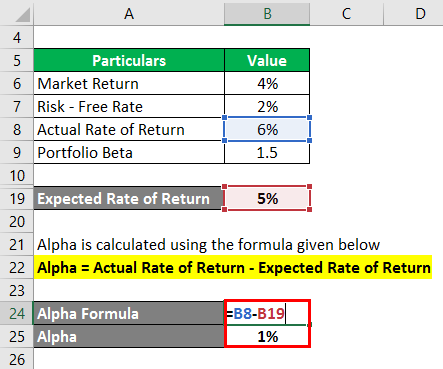

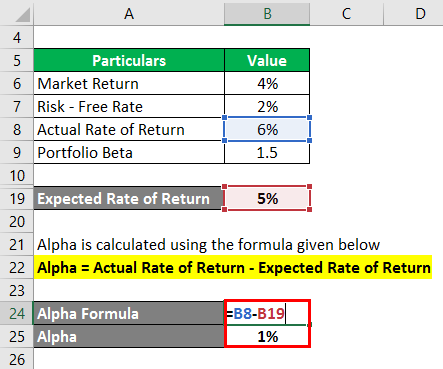

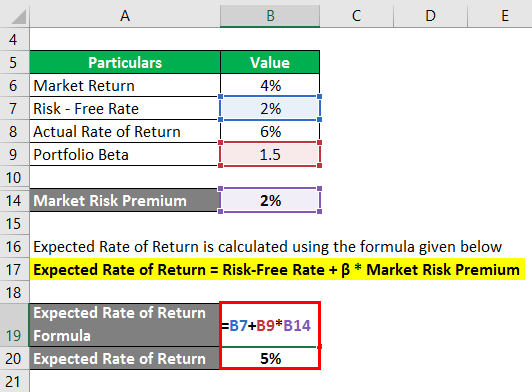

Alpha Formula Calculator Examples With Excel Template

How To Calculate Retention Rate In B2b Saas

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

What Startups Should Know About Monthly Active Users Mau Baremetrics

Market Share Formula And Percentage Calculator Excel Template

Information Ratio Financial Edge

Free Float Market Capitalization Formula How To Calculate

![]()

How To Measure Active Users And Everything You Need To Know

Net Asset Value Nav Formula And Nav Per Share Calculation

Alpha Formula Calculator Examples With Excel Template

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Alpha Formula Calculator Examples With Excel Template

You Re Measuring Daily Active Users Wrong